Mark up rate calculator

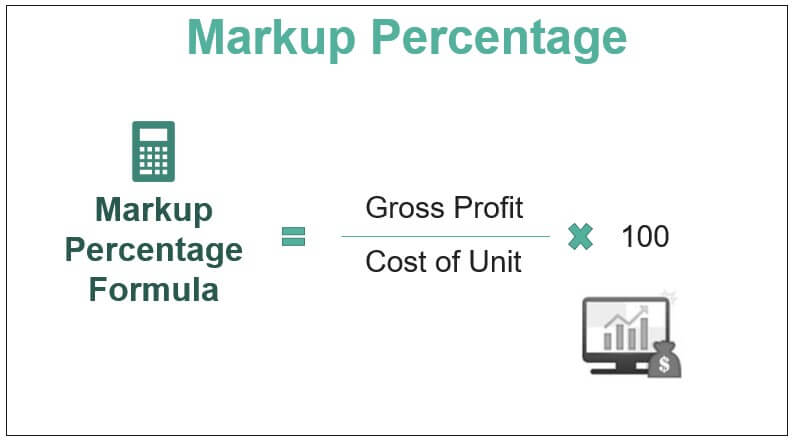

The markup formula is as follows. This calculator calculates the markup percentage using profit product original cost values.

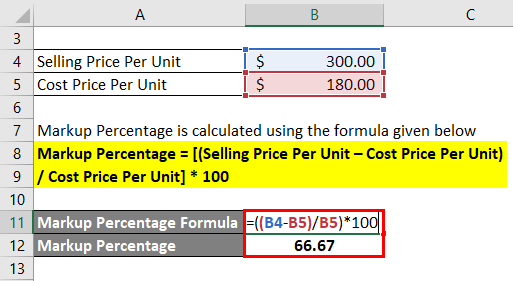

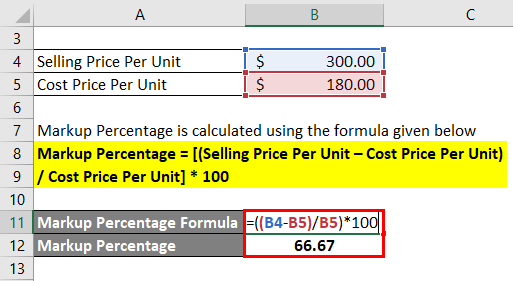

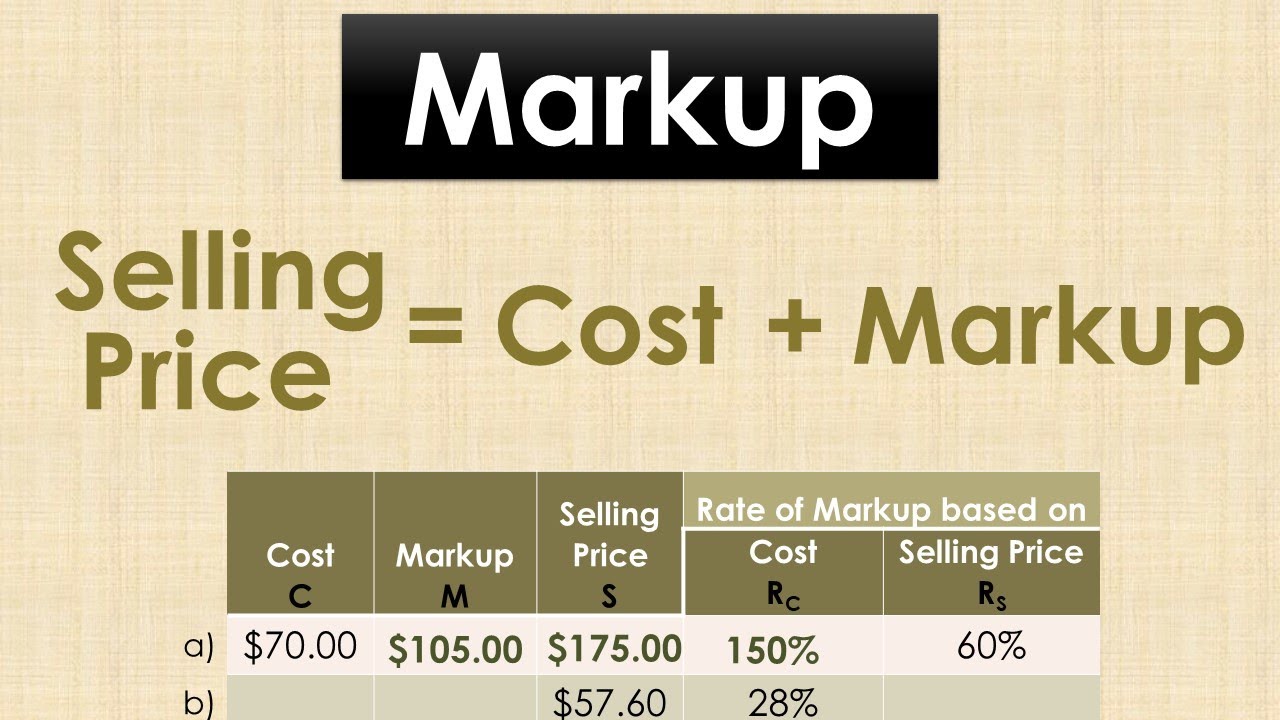

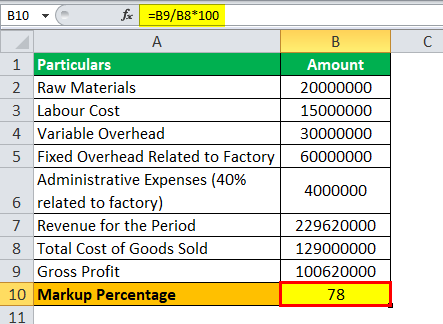

Markup Percentage Formula Calculator Excel Template

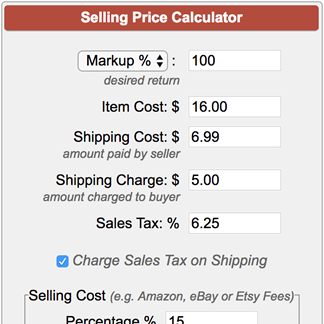

Be careful to select the correct GSTVAT rate.

. You will find that. 10 40 025. Set the other three inputs Net Amount Amount and Discount Percentage to 00.

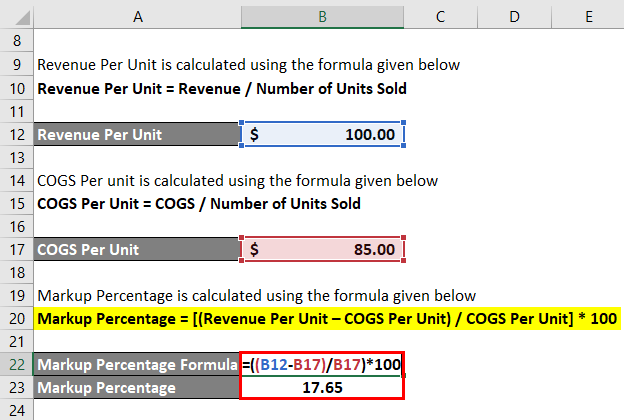

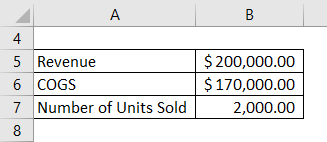

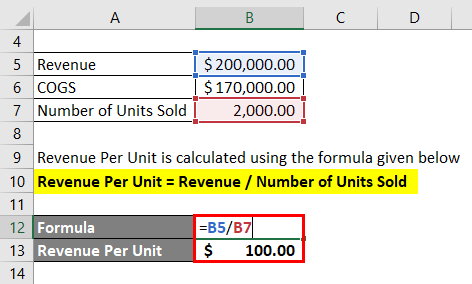

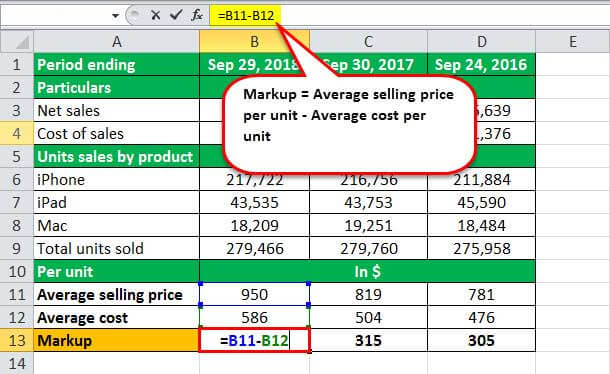

For example if a product costs 10 and the selling price is 15 the markup. Divide profit by COGS. Selling price revenue is obtained by dividing the original cost by 1 Gross margin rate.

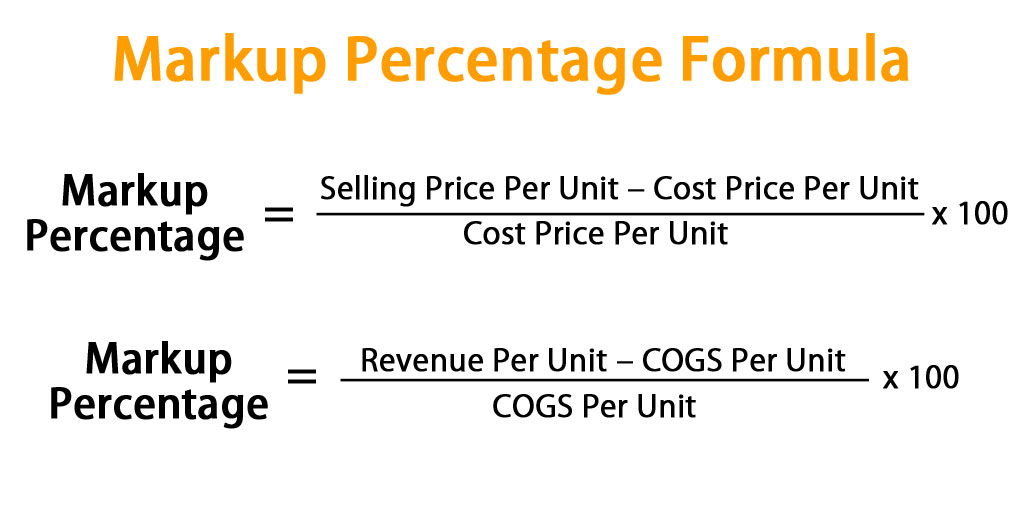

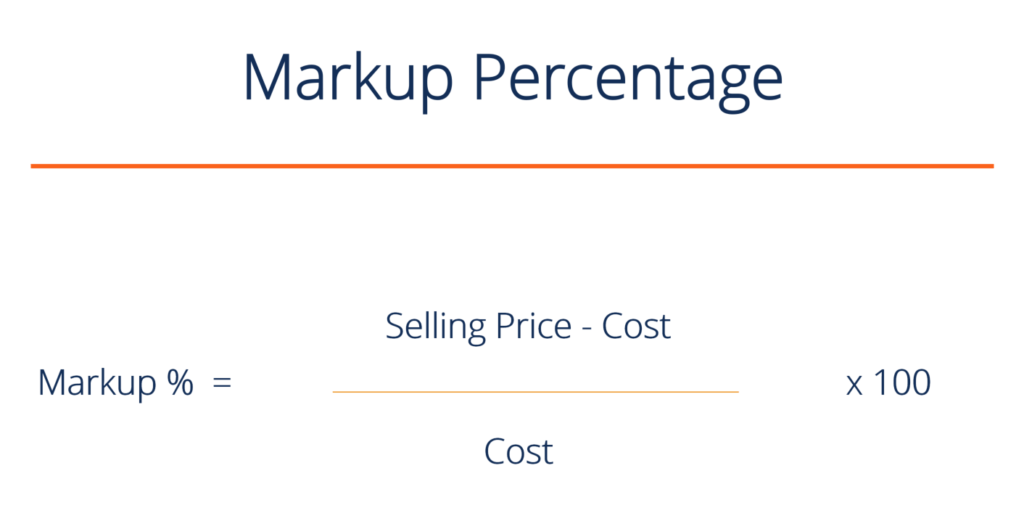

Markup 100 revenue cost cost. Gross profit will be. MARKUP PERCENTAGE SELLING PRICE UNIT COST UNIT COST x 100 Simply take the sales price minus the unit cost and divide that number by the unit cost.

Markup Calculator is a tool that helps you to calculate the desired average markup price for your product or service. To determine his markup percentage he uses the formula. The approach is easy to use relying only on the average markup rate and unit cost doesnt require.

On the calculator enter. Both Mark Up and GP are noted in the answer section of the calculator. Simply add the cost of goods to the result of multiplying the cost of goods services by the markup rate.

The Net Amount before sales. About Markup Calculator The Markup Calculator is used to calculate the markup percent which is the proportion of total cost represented by profit. Markup Percentage Formula The formula for calculating markup percentage can be expressed as.

Example of a calculation Assuming that the original cost of a product was 1000 and a gross. For example with a rate of 40 and a cost of 100 the markup price is simply. So the formula of markup becomes.

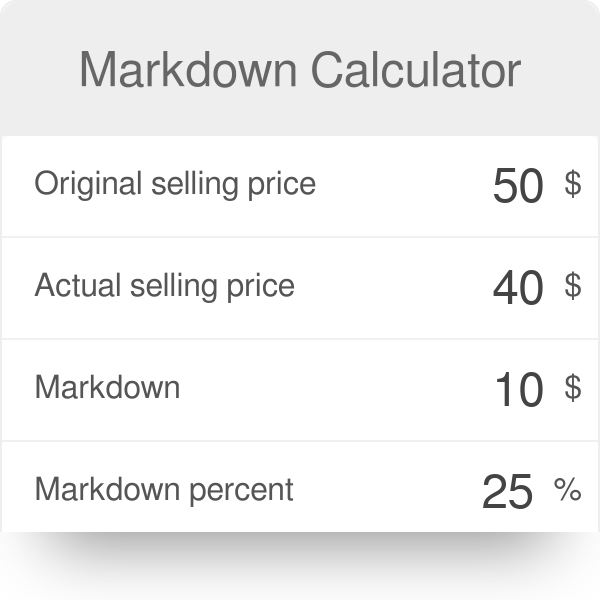

The in-built calculator of this tool applies the latest state-wise statutories such as FICA FUTA SUTA and others as required by the respective state to your target pay-rate and markup to. The discount you allow is the price markdown. He includes 75 as his selling price.

Enter the sales tax rate into the Markup Percentage say 7. Pricing Approach does not take into account factors like change in. Markup percentage selling price - cost cost x 100 Abram inputs his numbers.

Or given as a percentage the markup percentage is 429 percent calculated as the markup amount divided by the product cost calculated as the markup amount divided by the. To understand the impact of GSTVAT on your pricing. Gross Margin 75.

50 40 10. Then multiply by 100. If you need the selling price This is probably the most common.

And try revenue cost cost markup 100. The calculation is based on a products. The markup calculation calculator is a tool for businesses that calculates your sales price.

025 100 25. Profit Product Original Cost Calculate Reset. Markup 100 profit cost.

What Is Margin Markup Vs Margin Definition Calculator Formula More

Markup Percentage Formula Calculator Excel Template

Markup Selling Price Cost With Solved Problems Youtube

Markup Percentage Formula Calculator Excel Template

Markup Percentage Formula Calculator Excel Template

Markup Formula How To Calculate Markup Step By Step

Markup Formula How To Calculate Markup Step By Step

Markup Percentage Definition Formula How To Calculate

Markdown Calculator

Markup Calculator Markup Rate Markup Price Calculator

Markup Percentage Formula Calculator Excel Template

Markup Percentage Definition Formula How To Calculate

Markup Percentage Definition Formula How To Calculate

Markup Formula How To Calculate Markup Step By Step

Selling Price Calculator

How To Calculate Markup In Excel Techwalla

Markup Calculator Calculate The Markup Formula Examples