Ad valorem tax calculator

Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property. Title Ad Valorem Tax TAVT became effective March 1 2013 after the Georgia General Assembly passed HB386 in the 2012 Legislative Session.

Property Tax Calculator

The legal basis is Title II of the Local Government Code LGC Republic Act RA no.

. 2023 Trend and Depreciation Trend and Percent Good Tables for Tax Year 2023. Title Ad Valorem Tax TAVT Calculator Frequently Asked Questions on TAVT GA Department of Revenue. Title Ad Valorem Tax TAVT Calculator.

You may visit the Title Ad Valorem Tax Calculator to compare the current annual ad valorem tax and the new one-time Title Fee. You can calculate your Title Ad Valorem Tax due using the Georgia DORs TAVT Calculator. The fair market value is established each year by the Tax Assessors.

We use all legal measures to collect delinquent tax from those who willfully refuse to pay. DOWNLOAD CURRENT TAVT ASSESSMENT MANUAL TITLE AD VALOREM TAX CALCULATOR. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties within the municipalities and unincorporated areas of Lake County Florida.

The RPT for any year shall accrue on the first day of January and from that date it shall constitute a lien on the. The Delinquent Tax Divisions mission is to maximize collection of ad valorem tax by working with taxpayers in financial difficulty and maintaining an on-going levy program. Get the estimated TAVT tax based on the value of the vehicle using.

7160 can be found here. Local governments typically assess property tax and the property owner pays the tax. Taxes in Germany are levied by the federal government the states as well as the municipalities StädteGemeindenMany direct and indirect taxes exist in Germany.

Taking Advantage of Property Tax Abatement Programs. STC-1232-C Commercial Business Property Return. The value is based on what is on the property as of January 1 and ownership is established by who owns it on January 1.

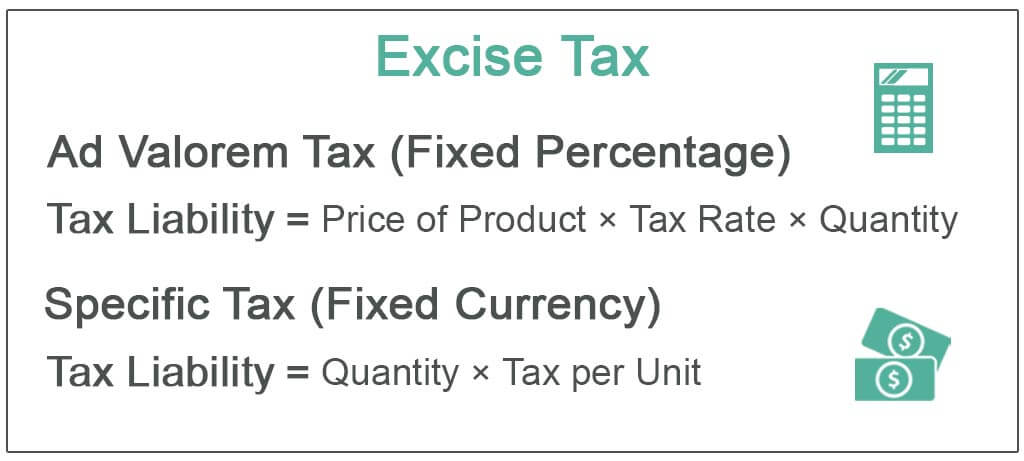

Whats an Ad Valorem Tax. This calculator is intended to provide an estimate of the ad valorem. 110-CSR-1P Legislative Rule Title 110 Series 1P Valuation of Commercial and Industrial Real and Personal Property for Ad Valorem Property Tax Purposes.

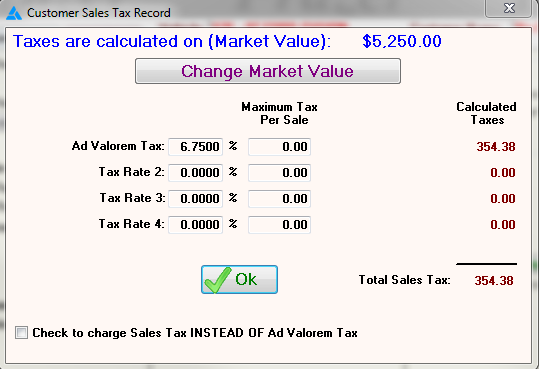

Tag Information Georgia Tags You will be able to see what they look like where available cost and requirements. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. This comparison can then be used to see an estimate of the opt-in credit you may receive for sales tax and ad valorem taxes paid on a vehicle purchased between January 1 2012 and February 28 2013.

Pay Tax Bill View Tax Bills Tag Address Change Property Tax Vehicle Information Booklet Property Taxpayers Bill of Rights. Following a tax sale any overage of funds known as excess funds is placed in a separate account. Application for Ad Valorem Property Tax Treatment as Certified Capital Addition Property.

Tax Estimation Calculator. Real Property Tax is the tax on real property imposed by the Local Government Unit LGU. TAVT QUICK REFERENCE GUIDE FOR DEALERS.

Ad valorem taxes are due each year on all vehicles. For a used motor vehicle not listed in the manual FMV is the value from the bill of sale or the clean retail value provided by NADA National Automobile Dealers Assoc January 2018 Edition whichever is higher. The mechanical vehicle circulation tax Impuesto sobre Vehículos de Tracción Mecánica or IVTM is an annual tax.

48-4-5 excess funds may be claimed by the record owner of the property at the time of the tax sale by the record owner of each security deed affecting the property and by any other party having any recorded equity interest or claim in such property at. Instead of paying taxes when you renew your registration you only pay tag fees. An increase in the future millage rate may further increase taxes and non Ad Valorem assessments are subject to change.

We would like to show you a description here but the site wont allow us. The registration tax impuesto de matriculation applies at purchase time to the purchase price. Understanding Your Property Tax Bill Property tax bills are available online.

The legal basis for taxation is established in the German Constitution Grundgesetz which lays out the basic principles governing tax law. Most taxation is decided. In some states such as Georgia you pay a title ad valorem tax up front on the capitalized lease cost or lease price see Georgia Car Lease for recent changes.

A tag renewal notice lists ad valorem tax and tag renewal fees due along with any other applicable fees that must be collected to renew the vehicles registration. Annual Ad Valorem tax is a value tax that is assessed annually and must be paid at the time of registration. This tool is for estimation purposes only and should not be used for or relied upon for any other purpose.

What Is Assessed Value. Annual Ad Valorem tax applies to most vehicles not taxed under TAVT or alternative ad valorem tax. Income tax and VAT are the most significant.

In some cases regions may fix their own rates. It is a national tax and the rate varies from 0 to 1475 depending on CO 2 emissions. This tax is based on the value of the vehicle.

Payment of ad valorem tax is a prerequisite to receiving a tag or renewal decal. For example if a property with a gross assessed value of 100000 has a tax bill of 2100 and the circuit breaker percentage cap is 2 a tax credit in the amount of 100 would be issued for that property thereby reducing the property tax amount due to 2000 or 2 of its gross assessed value. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to.

7160The implementing rules and regulations of R. A TAVT Calculator is available on the Department of. In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were.

Whats a Special Assessment Tax. Renewal notices are mailed approximately 45-60 days prior to the registration expiration date by the State of Georgia. Tax brackets result in a progressive tax system in which taxation progressively increases as an.

We would like to show you a description here but the site wont allow us. A tax bracket refers to a range of incomes subject to a certain income tax rate. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the vehicle.

Emails Regarding Property Tax. When you renew you need a. What Does Mill Rate Mean.

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. The ad valorem tax means that it is a tax based on value.

Car Tax By State Usa Manual Car Sales Tax Calculator

Excise Tax Definition Types Calculation Examples

The Property Tax Equation

Calculating Personal Property Tax Youtube

Understanding California S Property Taxes

Property Tax Calculator Property Tax Guide Rethority

Tax Rates Gordon County Government

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax Calculator Property Tax Guide Rethority

Real Estate Property Tax Constitutional Tax Collector

Property Taxes Useful Tips Charleston Sc Kristin B Walker Realtor

Township Of Nutley New Jersey Property Tax Calculator

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Tax Rates Gordon County Government

Property Tax Calculator

Frazer Software For The Used Car Dealer State Specific Information Georgia

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease